222018-Central Tax dated 6-8-2018 has been rescinded vide Notification No. The GST standard rate has been revised to 0 beginning the 1st of June 2018 pending the total removal of the Goods and Services Tax Act in parliament.

Sweet Maxwell Malaysia Online Bookstore

THE UTTARANCHAL CENTRAL SALES TAX RULES 2007.

. The individual paying the service tax can be either a receiver or a provider. But the list of Goods or services not yet declared by the Government for implementation of the provision. The Sales of Goods Act was first passed in 1896.

Central GST CGST. 12 of 1996 XVIII. The Sale of Goods Act 1957 applies.

Case Laws - All States. New Zealands Sale of Goods Act was passed in 1908 by the Liberal Government of New Zealand. Section - 276B.

Interest payable for non-payment of tax by domestic companies. Short title extent and commencement. Cancellation and return of warehousing bond.

Amending Act 7 of 1997- It is considered necessary to amend the Karnataka Tax on Luxuries Hotels Lodging Houses and Marriage Halls. When company is deemed to be in default. As amended by Finance Act.

16 Records Page 1 of 2 Section - 115Q. Instruments chargeable with duty. List of Goods under RCM in GST.

Central GST Act 2017 CGST Central GST. Drawback allowable on re-export of duty-paid goods. No credit or refund of any amount paid pursuant to sections 34 to 38 inclusive of the Sales and Use Tax Act chapter 397 Statutes of Nevada 1955 and NRS 372210 to 372255 inclusive may be allowed on the ground that the storage use or other consumption of the property is exempt under section 67 of the Sales and Use Tax Act unless the.

A1 From the third Sunday in August until the Saturday next succeeding inclusive during the period beginning July 1 2004 and ending June 30 2015 the provisions of this chapter shall not apply to sales of any article of clothing or footwear intended to be worn. 100 Records Page 1 of 10 Section - 1. Under the act goods sold from owner to buyer must be sold for a certain price and at a given period of time Malaysia.

Tax suspended for one week in August for sales of clothing or footwear of less than one hundred dollars. Central Sales Tax Act 1956. Penalty for failure to deduct tax at source.

Entry Tax Act 2008. CST Registration And Turnover Rules 1957. As per section 80 of the Finance Act 1994 if a person.

CST Rules 1957. Zero-rated and exempted supplies. 12019-Central Tax Rate dated 2912019 said section 94 has been forced wef122019.

By May 2018 the new Malaysian government led by Mahathir Mohamad decided to reintroduce the Sales and Services tax after completely scrapping GST. Service tax was in the past a form of tax that was collected by the Indian Government for certain goods and services. VAT tax collected at every transaction for a goods.

Case Laws - All States. Obtained from LA Bill No. Custody and removal of warehoused goods.

In this article we are discussing such goods and services which have been notified by the Central Government for the purposes of RCM. Section - 3A. Income Tax Act 1957 and the Karnataka Sales Tax Act 1957 to give effect to the proposals made in the Budget speech and matters connected therewith.

Regarding implementation of generation of e-way bill for intra-state movement of goods wef 20042018. Since introduction of GST the Central Government has notified a number of goods and services us 93 of CGST Act for the purpose of levy of GST under reverse charge mechanism. The cited provision has been deferred till 30th September 2019 vide Notification No.

CENTRAL GOODS AND SERVICES TAX ACT 2017. Goods improperly removed from warehouse etc. Central sales tax Act 1956.

Goods not to be taken out of warehouse except as provided by this Act. INSTAVAT Info Private Ltd Maharashtra Andhra Pradesh State India professional consultants having experience in the field of Sales Tax of more than 25 yearsSales tax is charged at the point of purchase for certain goods and services in Maharashtra State IndiaService tax charged on service providers in Maharashtra State India. Income Tax Department Tax Laws Rules Acts Indian Stamp Act 1899 Choose Acts.

Criteria there are also provisions for not imposing penalty in the service tax rules. Short title extent and commencement.

Law T5q4d Pptx 4 Explain Whether The Following Transactions Falls Under The Sales Of Goods Act 1957 C Frank Agrees To Buy Shares In Abc Sdn Bhd Course Hero

Sale Of Goods Act 1957 Act 382 2019 As 15 June 2019 Shopee Malaysia

Unpaid Seller Under The Sale Of Goods Act Our Legal World

Sale Of Goods Act Law446 Studocu

Sale Of Goods Act 1957 Act 382 Marsden Professional Law Book

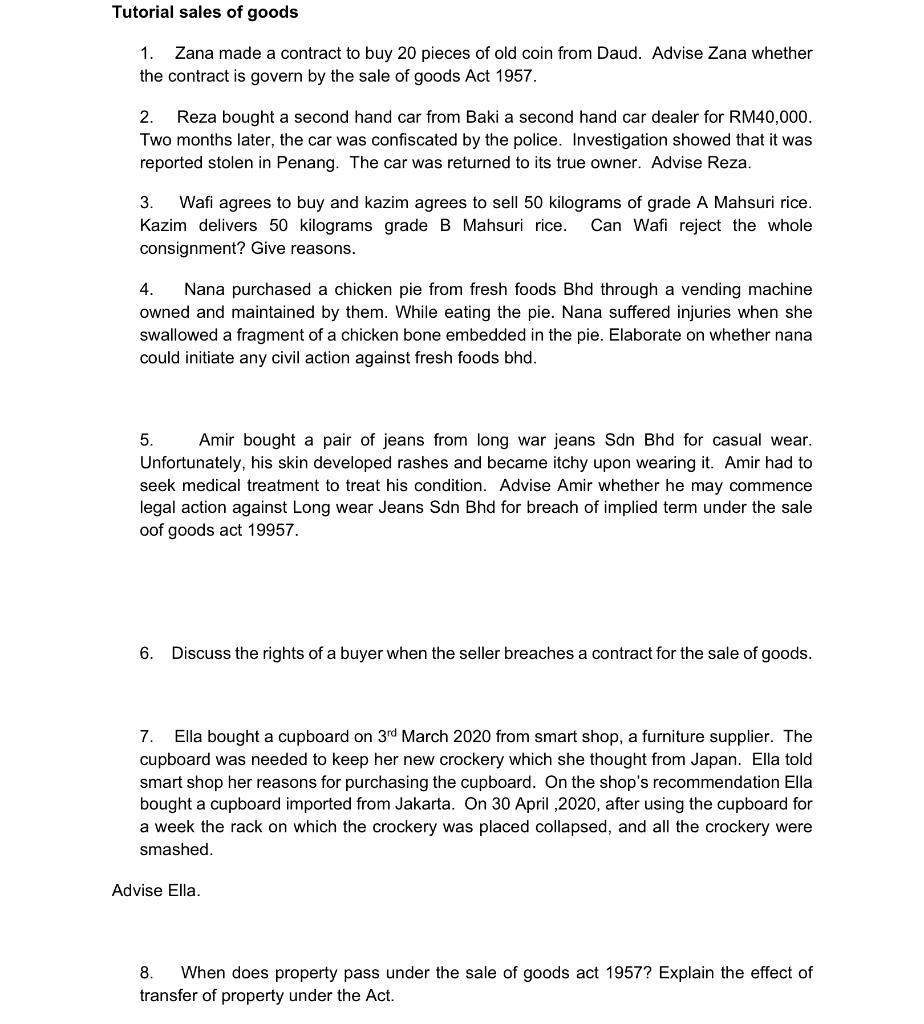

Solved Tutorial Sales Of Goods 1 Zana Made A Contract To Chegg Com

Pdf Consumer S Right To Redress Against Traders Under The Law Of Supply Of Goods A Comparative Study Of Selected Jurisdictions Kartini Aboo Talib Academia Edu

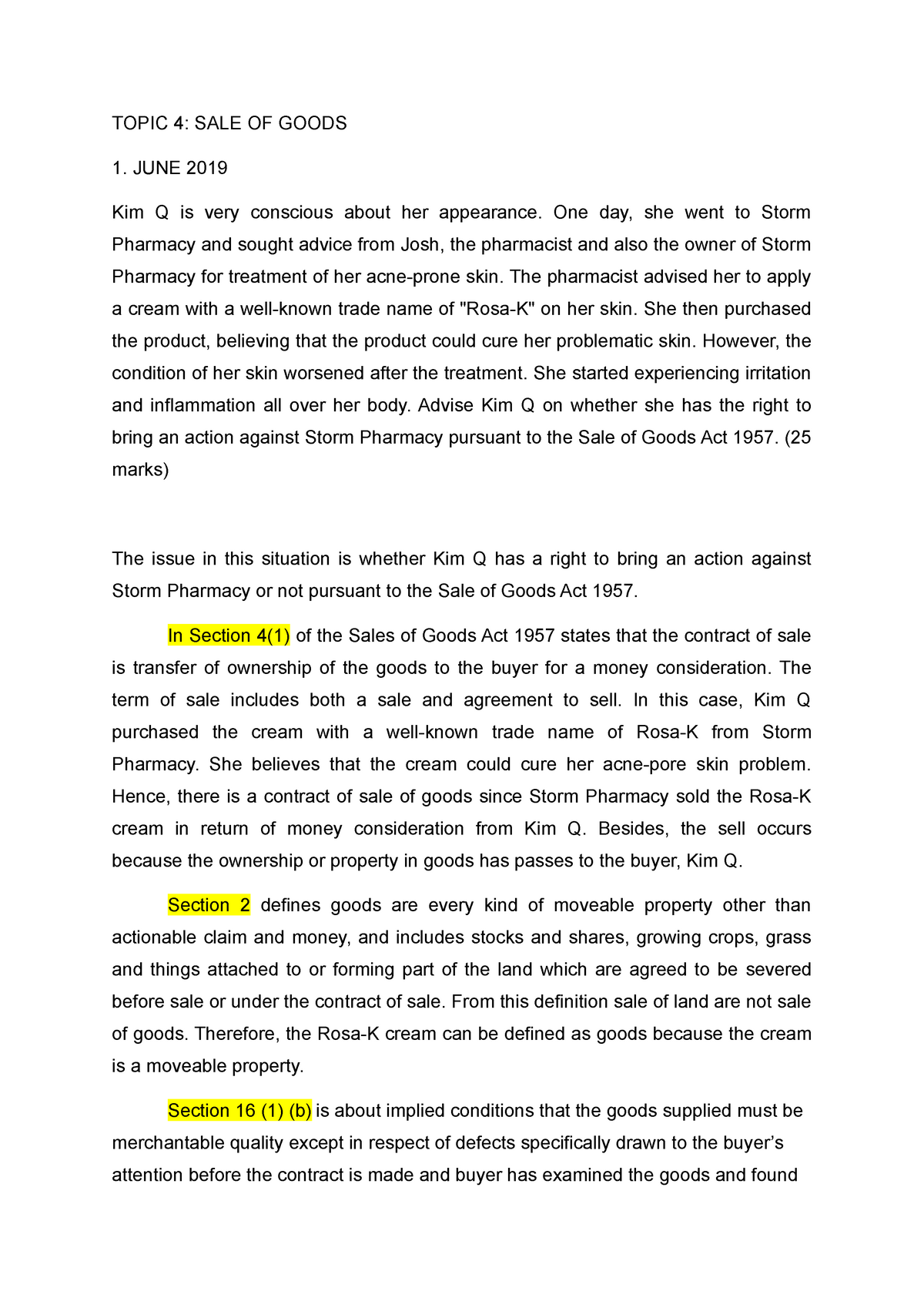

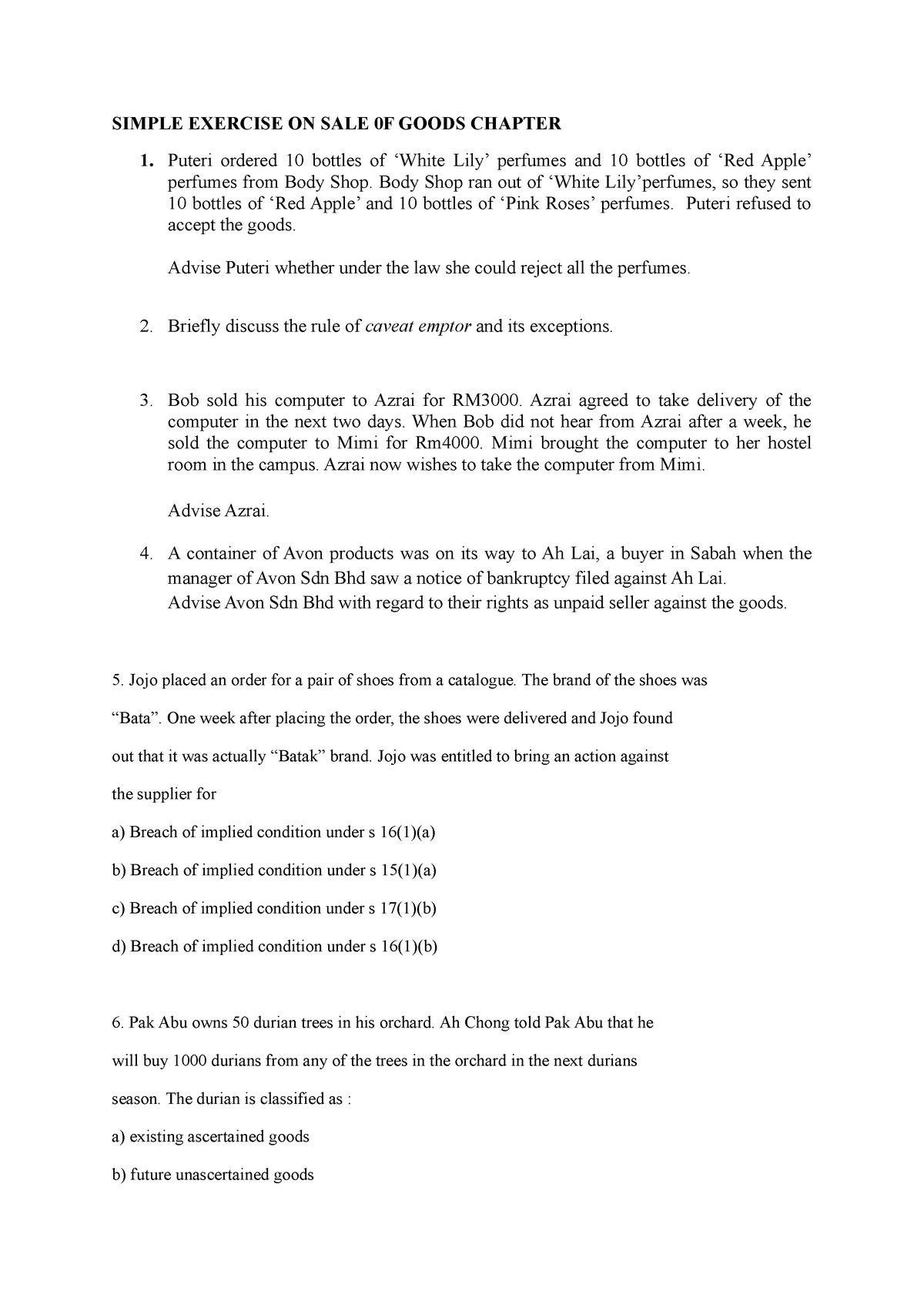

Simple Exercise On Sales Of Goods Act 1957 Simple Exercise On Sale 0f Goods Chapter 1 Puteri Studocu

Sales Of Goods Act 1957 Act 382 Pustaka Rawang

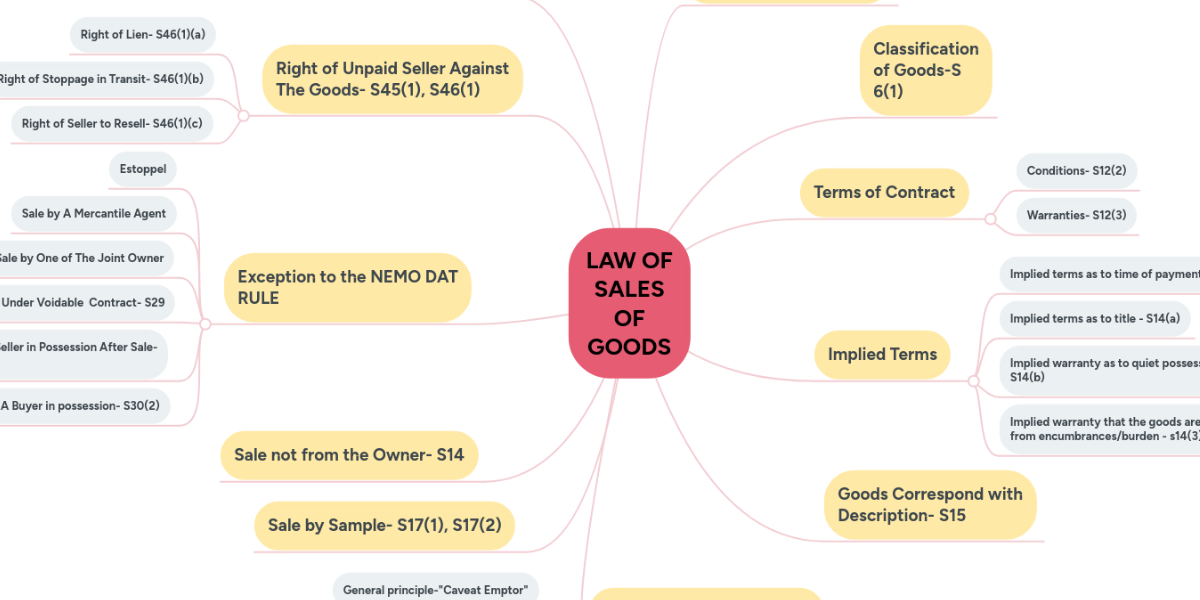

Law Of Sales Of Goods Mindmeister Mind Map

Discounts And Promotions From International Law Book Services Ilbs Shopee Malaysia

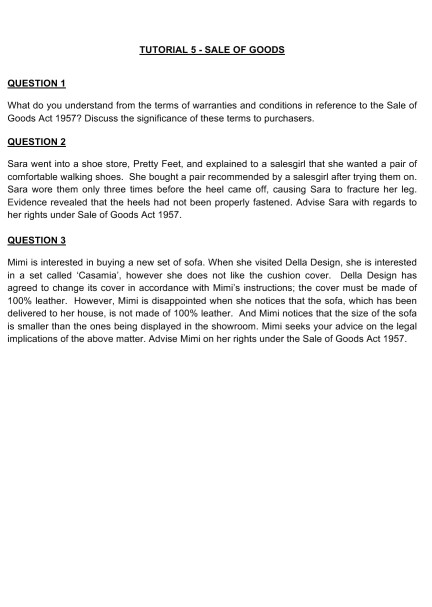

Solved Tutorial 5 Sale Of Goods Question 1 What Do You Chegg Com

B Law Final Docx The Legal Issue In This Case Is Richard Wished To Know About The Law Of Contract Sales Of Goods Act 1957 And The Contracts Act 1950 Course Hero

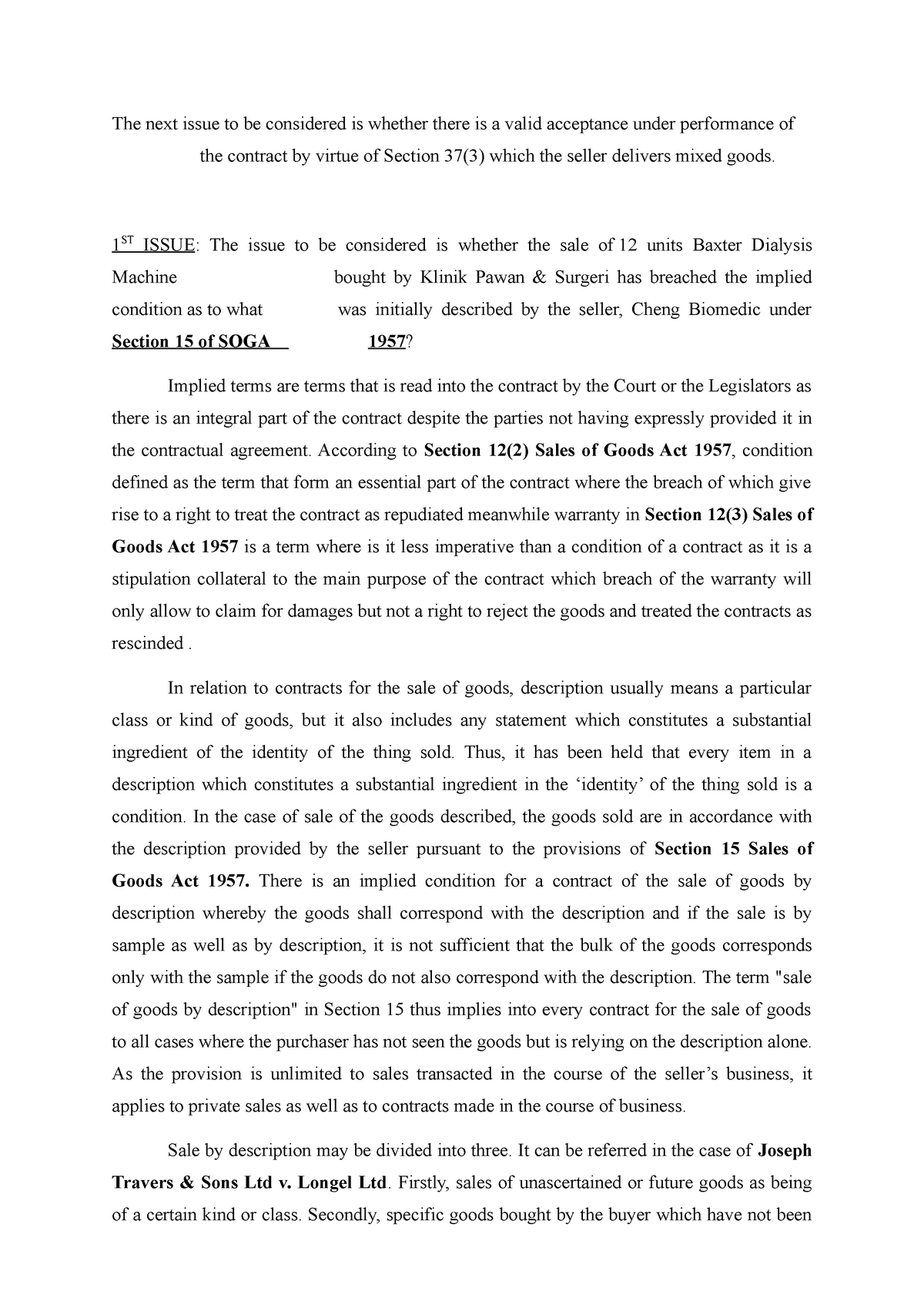

Soga Performance Of Contract The Next Issue To Be Considered Is Whether There Is A Valid Studocu

Ppt Sale Of Goods Powerpoint Presentation Free Download Id 6670114

Pdf Sale Of Goods Laws Of Malaysia Sale Of Goods Act 1957 Badegg Beng Academia Edu

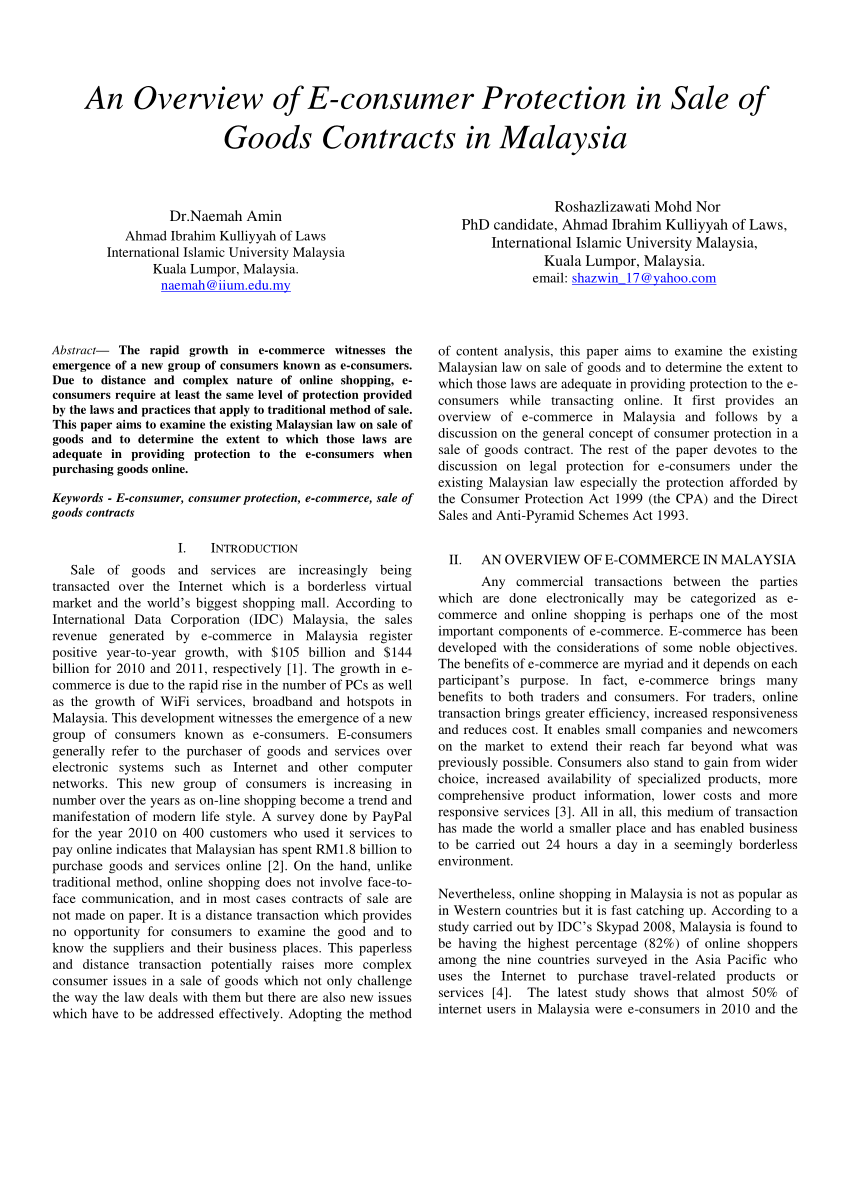

Pdf An Overview Of E Consumer Protection In Sale Of Goods Contracts In Malaysia

Laws Of Malaysia Sale Of Goods Act 1957 Revised 1989